fha gift funds limit

Earnest money deposited by the borrower. The new FHA Policy changes limit seller.

Fha Gift Funds How Can I Use Them To Buy A Home

Its worth noting that the lender is allowed to offer the borrower closing cost assistance as long as the aid does not exceed 6 of the sales price and stays within the total 6 limit.

. Most home buyers who use FHA come up with at least 35 percent down from their own funds. For example a man. Being this close to the end of the year the gift-giver may want to consider withholding 15000 or 30000 if married of the gift for January so as to avoid wasting their gift tax exemption.

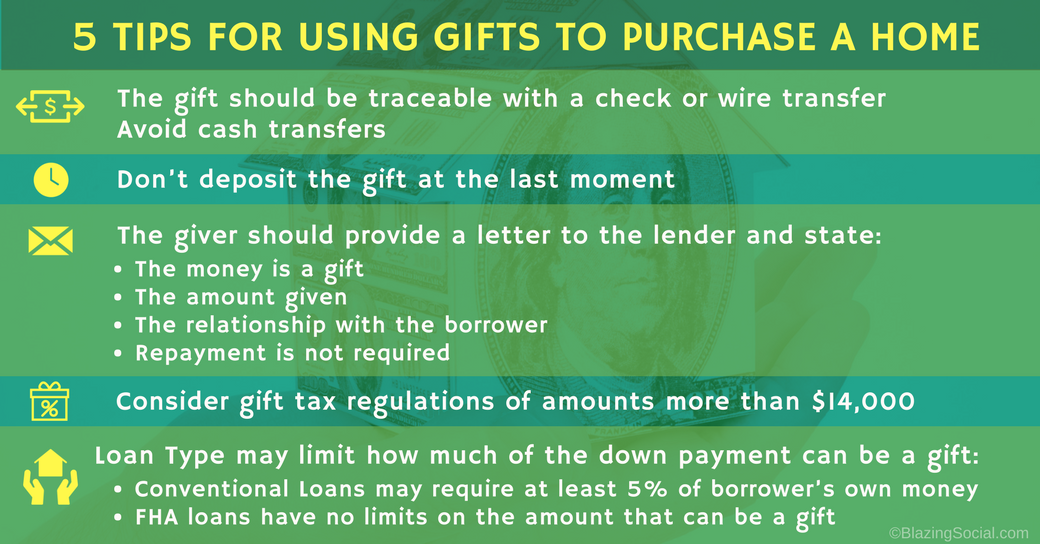

Specify the date the funds were transferred. All funds needed to complete the transaction can come from a gift. When a borrower applies for an FHA home loan a down payment is required for all transactions.

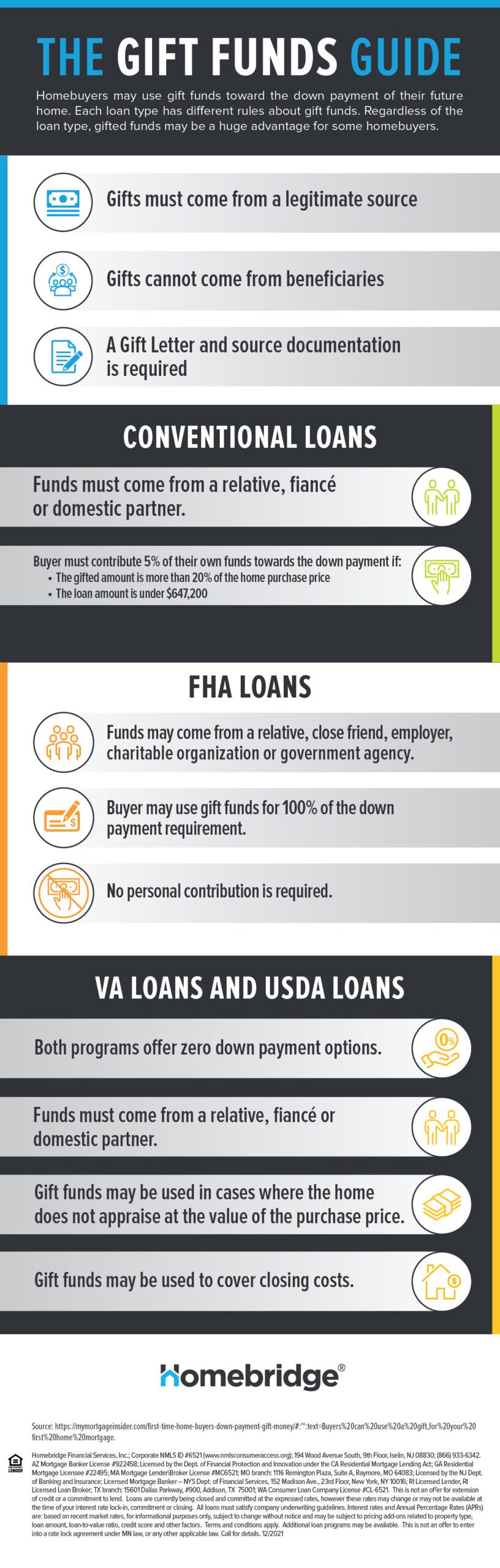

The short answer is yes in 2019 the minimum required down payment for an FHA loan which is 35 can be gifted from a family member a friend an employer or some other approved source. A statement that no repayment is required. All funds needed to complete the transaction can come from a gift.

All gift funds for the down payment must comply with the same rules that apply to the FHA loan applicant for the down payment. LTV CLTV or HCLTV Ratio Minimum Borrower Contribution Requirement from Borrowers Own Funds 80 or less One- to four-unit principal residence Second home A minimum borrower contribution from the borrowers own funds is not required. Gifts toward down payment do not have to always be in cash.

The portion of the gift not used to meet closing requirements may be counted as reserves. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. Our FHA loan calculator demonstrates how quickly that adds up.

Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. Sellers Concessions-FHA mortgage requirements allow for seller concessions of up to 6 of the sales price. This gives the buyer instant equity of 130000.

The gift letter must. Any donation money must be documented by a gift letter signed by both the donor and the borrower. Specify the dollar amount of the gift.

FHA loans do not require notarization of the borrowers signature. A family member can also use equity in a property as gift funds. Provide executed gift letter.

While 35 is relatively small when compared to conventional loans with 5 to 20 down payments 35 is 3500 for every 100000 in purchase price. Gift Funds Already Received. Gifts clearly given because of a family relationship or personal friendship.

Unlike VA home loans FHA mortgages do not have a zero-money-down option. Provide signed and dated gift letter from the. Funds in an individual checking or savings account.

Minimum Borrower Contribution Requirement from Borrowers Own Funds. The date the funds were transferred. According to the IRS gift tax exclusions in 2022 any down payment gift below 16000 does not have to be reported.

Some of the more common exceptions to the gift prohibition allow employees to accept --Unsolicited gifts with a value of 20 or less. Free attendance at a widely attended gathering Discounts and similar opportunities and benefits available to all Government employees. In addition to FHA permitting seller paid closing costs up to 6 of the purchase price FHA loans require only a 35 down payment.

Some buyers may struggle to come up with a down payment on the FHA mortgage which is why the rules allow borrowers to accept funds from outside sources to help pay for up-front. Thats more than enough to cover a down payment of 35 percent which is required by the FHA. Some of the funds that are acceptable sources of closing costs and down payments include.

Gift of equity 35 down payment. Gifts must be evidenced by a letter signed by the donor called a gift letter. HUD 40001 instructs the lender to obtain a gift letter signed and dated by the donor and Borrower that includes the following.

Include the donors statement that no repayment is expected. Beyond that amount the funds must be reported on the donors gift tax return. The donors name address phone number and relationship to the borrower.

Seller Concessions and Reserves. This is all spelled out in HUD Handbook 40001 the Single Family Housing Policy Handbook. One- to four-unit principal residence Second home.

By accepting a gift of equity credit the seller is basically paying the down payment for the buyer. This could mean that buyers essentially can purchase a home with no cash down payment thanks to the sellers discount. A minimum borrower contribution from the borrowers own funds is not required.

The gift can come from any. The dollar amount of the gift. Your donor must send your lender a mortgage gift lender accompanied by a paper trail to back it up.

The accompanying paper trail should. In turn parents can collectively give up to 32000 per child without needing to report those funds to the IRS. However the FHA program allows you to obtain the downpayment through a gift.

Documentation Required for a Gift Money. This is providing the equity is enough to. Retirement and investment accounts.

Both the borrowers and sellers must meet certain guidelines to participate in a gift-of-equity arrangement. Proceeds from the sale of another home. The gift funds cannot come from a payday loan.

The gifted funds must be sourced and seasoned and cannot be borrowed by the donor. A statement that no repayment is expected. Indicate the donors name address telephone number and.

Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor.

Fha Down Payment And Gift Rules Still Apply

2021 Fha Loan Guide Requirements Rates And Benefits Dontu Net

Fha Gift Funds How Can I Use Them To Buy A Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

2022 How To Use Gift Funds For Fha Loan Closing Costs Fha Co

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter

Fha Gift Funds Definition And Guidelines Rocket Mortgage

Fha Gift Funds Guidelines 2022 Fha Lenders

Gift Letter Document Gift Funds For Fha Or Conventional Loans

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Using Gift Funds To Buy A Home Homebridge Financial Services

Fha Loan Rules For Down Payment Gift Funds

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Gift Funds How Can I Use Them To Buy A Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Who Can Benefit From A Fha Loan Blog Usa Mortgage

Can I Use Gift Money For My Fha Home Loan Down Payment Fha News And Views